Introduction to Transfer Pricing

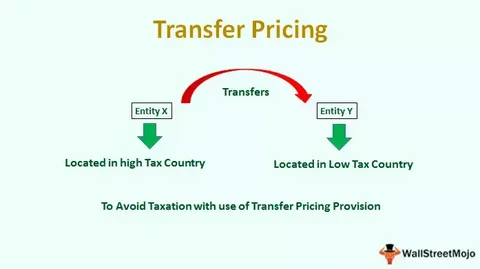

Transfer pricing refers to the pricing of goods, services, and intangibles between related entities within a multinational corporation (MNC). It is a critical aspect of international business as it affects where profits are reported and how much tax is paid in different countries. Given the complexity and the varying tax laws across jurisdictions, optimizing transfer pricing strategies is essential for MNCs to ensure compliance and minimize tax liabilities. Understanding and effectively managing transfer pricing can significantly impact a company’s financial health and global operations.

The Importance of Transfer Pricing

Transfer pricing is crucial for several reasons. Firstly, it ensures that MNCs allocate income appropriately among different countries where they operate. This allocation affects the amount of tax each country collects, which is vital for maintaining a fair tax base and avoiding double taxation. Secondly, transfer pricing compliance is necessary to avoid penalties and audits from tax authorities. Countries are increasingly scrutinizing MNCs to ensure they adhere to transfer pricing regulations. Lastly, an optimized transfer pricing strategy can help MNCs streamline their operations, making them more efficient and competitive in the global market. By understanding the importance of transfer pricing, MNCs can better navigate the complexities of international taxation.

ADDITIONALLY : “Ready to optimize your business’s financial strategies? Explore how expert advice on transfer pricing Dubai can enhance your profitability and compliance. Contact us today to schedule a consultation and stay ahead in a competitive market.”

Challenges in Transfer Pricing

MNCs face numerous challenges in transfer pricing. One significant challenge is the differing transfer pricing regulations across countries. Each country has its own rules and documentation requirements, which can be time-consuming and costly to comply with. Additionally, the lack of a standardized approach can lead to inconsistencies and disputes between tax authorities. Another challenge is the need for accurate and comprehensive data to justify transfer pricing decisions. Gathering this data can be difficult, especially for MNCs with complex supply chains and diverse business operations. Moreover, the ever-changing tax landscape requires MNCs to continuously monitor and update their transfer pricing strategies to remain compliant.

Strategies for Optimizing Transfer Pricing

Conducting Thorough Benchmarking Studies

One of the most effective strategies for optimizing transfer pricing is conducting thorough benchmarking studies. Benchmarking involves comparing the prices and profit margins of transactions between related parties to those of similar transactions between unrelated parties. This helps establish an arm’s length price, which is the price that would be charged between independent enterprises under similar circumstances. Conducting benchmarking studies regularly ensures that transfer pricing practices are aligned with market standards and can withstand scrutiny from tax authorities. MNCs can use databases, industry reports, and financial statements of comparable companies to gather relevant data for benchmarking.

Implementing Robust Documentation Practices

Robust documentation practices are essential for optimizing transfer pricing strategies. Proper documentation provides evidence that transfer pricing policies are in line with the arm’s length principle and comply with local regulations. This includes maintaining detailed records of transactions, transfer pricing policies, and the rationale behind pricing decisions. Documentation should also include functional analyses, which describe the functions performed, risks assumed, and assets employed by each entity in the MNC. By having comprehensive documentation, MNCs can demonstrate the integrity of their transfer pricing practices during audits and reduce the risk of penalties.

Utilizing Advanced Technology and Software

Advancements in technology have significantly improved the ability of MNCs to optimize their transfer pricing strategies. Specialized software can streamline the process of data collection, analysis, and reporting. These tools can help automate benchmarking studies, monitor compliance with local regulations, and generate detailed documentation. Additionally, technology can provide real-time insights into transfer pricing performance, allowing MNCs to make informed decisions and adjust their strategies as needed. By leveraging advanced technology, MNCs can enhance the accuracy and efficiency of their transfer pricing practices.

Engaging with Transfer Pricing Experts

Engaging with transfer pricing experts can provide valuable guidance and support in optimizing transfer pricing strategies. These experts have in-depth knowledge of international tax laws and transfer pricing regulations. They can assist MNCs in conducting benchmarking studies, preparing documentation, and navigating complex transfer pricing issues. Additionally, transfer pricing experts can provide strategic advice on structuring transactions, managing risks, and addressing disputes with tax authorities. By collaborating with experts, MNCs can ensure that their transfer pricing practices are compliant, efficient, and aligned with their overall business objectives.

The Role of Intercompany Agreements

Intercompany agreements play a vital role in transfer pricing optimization. These agreements outline the terms and conditions of transactions between related entities within an MNC. They serve as legal documents that support transfer pricing policies and provide a basis for determining the arm’s length price. Intercompany agreements should be detailed and consistent with the economic substance of the transactions. They should specify the roles and responsibilities of each entity, the pricing methods used, and the payment terms. By having well-drafted intercompany agreements, MNCs can mitigate the risk of transfer pricing disputes and demonstrate compliance with local regulations.

Continuous Monitoring and Review

Continuous monitoring and review of transfer pricing strategies are crucial for ensuring ongoing compliance and optimization. The global tax environment is dynamic, with frequent changes in regulations and tax policies. MNCs need to stay informed about these changes and assess their impact on transfer pricing practices. Regular reviews of transfer pricing policies, benchmarking studies, and documentation help identify areas for improvement and ensure that strategies remain effective. Additionally, monitoring transfer pricing performance through key performance indicators (KPIs) can provide valuable insights and facilitate timely adjustments. By continuously monitoring and reviewing their transfer pricing strategies, MNCs can maintain compliance and optimize their global operations.

Conclusion: Achieving Transfer Pricing Optimization

Optimizing transfer pricing strategies is essential for MNCs to ensure compliance, minimize tax liabilities, and enhance operational efficiency. By understanding the importance of transfer pricing, addressing challenges, and implementing effective strategies, MNCs can achieve transfer pricing optimization. Conducting thorough benchmarking studies, implementing robust documentation practices, leveraging advanced technology, engaging with transfer pricing experts, drafting detailed intercompany agreements, and continuously monitoring and reviewing strategies are all key components of a successful transfer pricing strategy. Through these efforts, MNCs can navigate the complexities of international taxation and achieve their business objectives.

For more insightful articles related to this topic, feel free to visit technotreats